With Interest Rates High, Inventory is Slow to See Increase

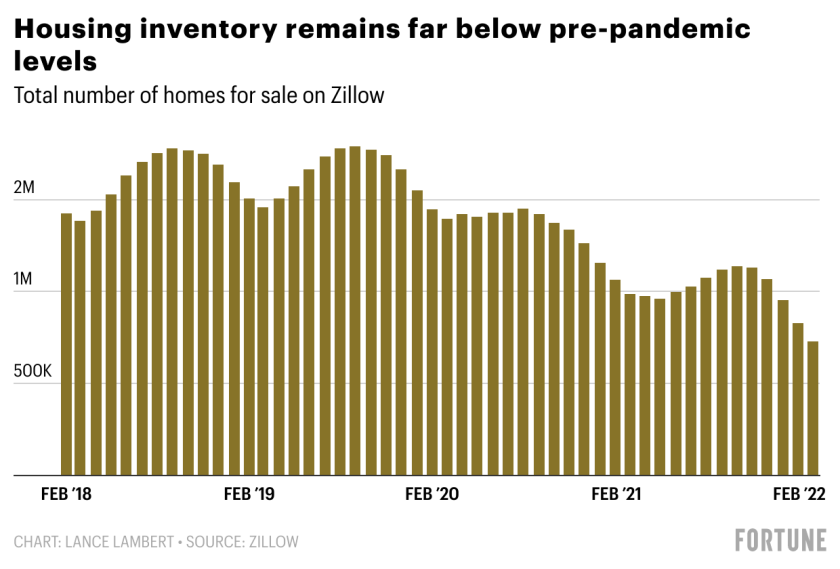

Although since May 2022, the active listings for homes have risen by 26%, the national housing market is yet to fully rebound since it hit record lows back in 2021 and early 2022. There are several factors that affect the low supply of homes, including less single family homes being built after the housing market crash in 2008, and an influx of first-time millennial homebuyers in 2022. As a side effect of the pandemic, many companies have begun to implement a remote work culture which gives people flexibility to move out from large, expensive cities to other parts of the country with low state and city property tax such as Nevada and Arizona. Consequently, investors are also attracted to those areas, bringing real estate developments and new constructions of apartments and multifamily dwellings. However, it is predicted that the demand in the housing market will also cool down because of rising interest rates. At this time, the desire to sell homes is low because the value of keeping a home is higher than selling and purchasing a new home to relocate. For buyers, the price of homes are projected to go down but they may be faced with limited inventory choices and expensive homeownership due to interest rate hikes.

Maryalene LaPonsie, Understanding Housing Inventory and What It Means for You, U.S. News & World Report, https://realestate.usnews.com/real-estate/articles/understanding-housing-inventory-and-what-it-means-for-you (Sept. 7, 2022).Tags: Demand for Home Purchase, Housing Inventory, Housing Market Crash of 2008, Interest Rate Hike, Investors, Lower Property Tax, Millennial Homeowners, pandemic, remote work, Supply Chain