Jersey City over the past 10 years has been building new luxury housing and high-rises along the Hudson River twice as fast as New York City. However, the big increase in Jersey City housing supply has not necessarily driven rent prices down due to the consistent high demand and high deficit of housing from the dense population living and working around the New York City areas. This phenomenon has driven many Jersey City locals to more affordable areas such as Newark and Elizabeth, New Jersey.

The surge in rent price for new apartments in Jersey City and a high demand that cannot be met by sufficient supply has given incentives to existing landlords in the community to also raise their rent prices to close rent gaps. With many NYC-based businesses also setting up satellite offices and/or moving into New Jersey, the demand for housing is further exasperated. Due to high rent prices, many local tenants have been evicted and/or are facing housing court.

Eliza Relman and Noah Sheidlower, NYC and its suburbs won’t build new housing, so New Yorkers are flooding into Jersey City and driving up prices, The Business Insider, https://www.businessinsider.com/jersey-city-real-estate-market-costs-rise-new-yorkers-move-2023-9 (Sept. 30, 2023).

In May, a few New York landlords along with the Rent Stabilization Association and the Community Housing Improvement Program filed a petition in the United States Supreme Court to consider arguments that the state’s rent stabilization represents “an unlawful taking of property without just compensation.” They claimed that the various rent laws in New York create a wide gap between the rent they receive and the costs they have to expend as a landlord and they are forced to offer low rent, lease renewals, and succession rights.

The passage of the Housing Stability & Tenant Protection Act of 2019 expanded the existing rental laws in New York which further regulated how and when the landlord can increase the rent and when landlords can take back the rental space. With income low and expenses high, many landlords have been facing foreclosures as an aftermath of inflation and high interest rates. However, the Supreme Court has previously only heard a small fraction of similarly structured cases related to rent control laws. Once again, the Supreme Court declined to hear this case on the alleged unconstitutionality of New York rent stabilization laws.

Kathryn Brenzel, End of the road? Supreme Court declines to take up challenge to New York’s rent law, The Real Deal, https://therealdeal.com/new-york/2023/10/02/supreme-court-rejects-ny-rent-law-challenge/ (Oct. 2, 2023).

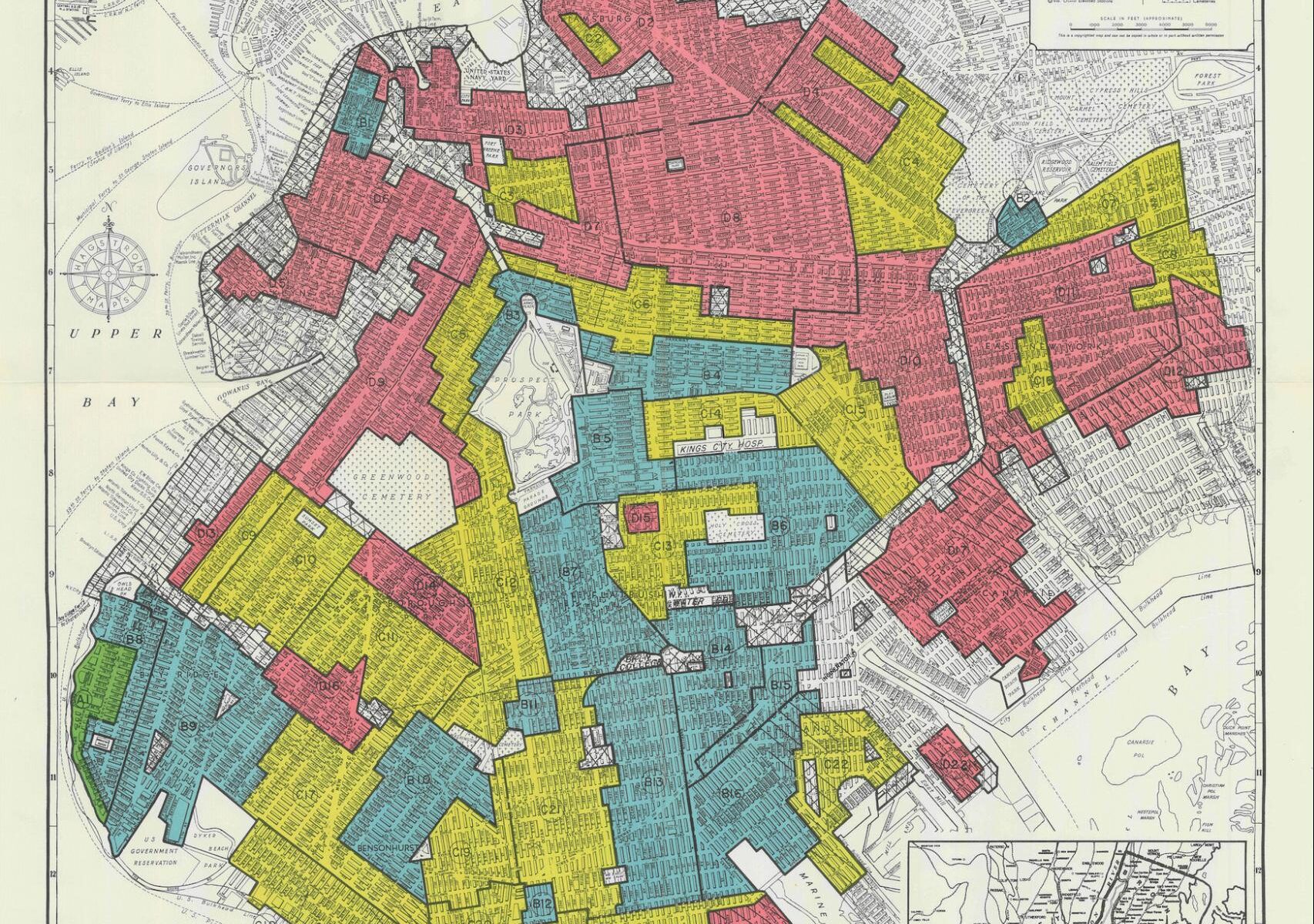

The Department of Justice (“DOJ”) filed a complaint against the Washington Trust bank company located in Rhode Island. The DOJ stated that the bank violated fair lending laws by purposely not offering home loan services at its branches in black and Hispanic-dominated neighborhoods. Furthermore, the DOJ alleged that the bank knew about these racial disparities yet did nothing to change their policies or do more outreach. The Washington Trust bank agreed to a $9 million settlement with the DOJ and to have two branches in black or Hispanic neighborhoods and assign mortgage officers focused on serving those areas.

Betsy Reed, Rhode Island bank agrees to pay $9m over discriminatory lending allegations, The Guardian, https://www.theguardian.com/us-news/2023/sep/27/rhode-island-bank-settlement-lending-discrimination-black-latino-neighborhoods (Sept. 27, 2023).

While the shelter populations have risen to unprecedented levels in New York City (“NYC”), NYC’s affordable housing options have decreased. On September 26, 2023, NYC Mayor Eric Adams announced the newest CityFHEPS rental assistance program expansion to address this issue. The CityFHEPS program extends its reach to housing units all across New York State, not just limited to the city. This expansion opens more space in the shelters for asylum seekers and increases stable housing for eligible groups such as low-income and older residents.

Mayor Adams Gives New Yorkers Ability To Use City-Funded Rental Assistance Vouchers Across New York State, The City of New York: Office of the Mayor, https://plus.lexis.com/newsstand/law360-real-estate-authority/article/1725930?crid=e34fcab8-32bb-4097-abd4-b3a8f45da03b (Sept. 26, 2023).

Michael Gartland, Mayor Adams Gives New Yorkers Ability To Use City-Funded Rental Assistance Vouchers Across New York State, New York Daily News, https://www.nydailynews.com/2023/09/26/city-funded-rent-vouchers-can-now-be-used-outside-nyc-under-new-mayor-adams-rule/article/1725930?crid=e34fcab8-32bb-4097-abd4-b3a8f45da03b (Sept. 26, 2023).

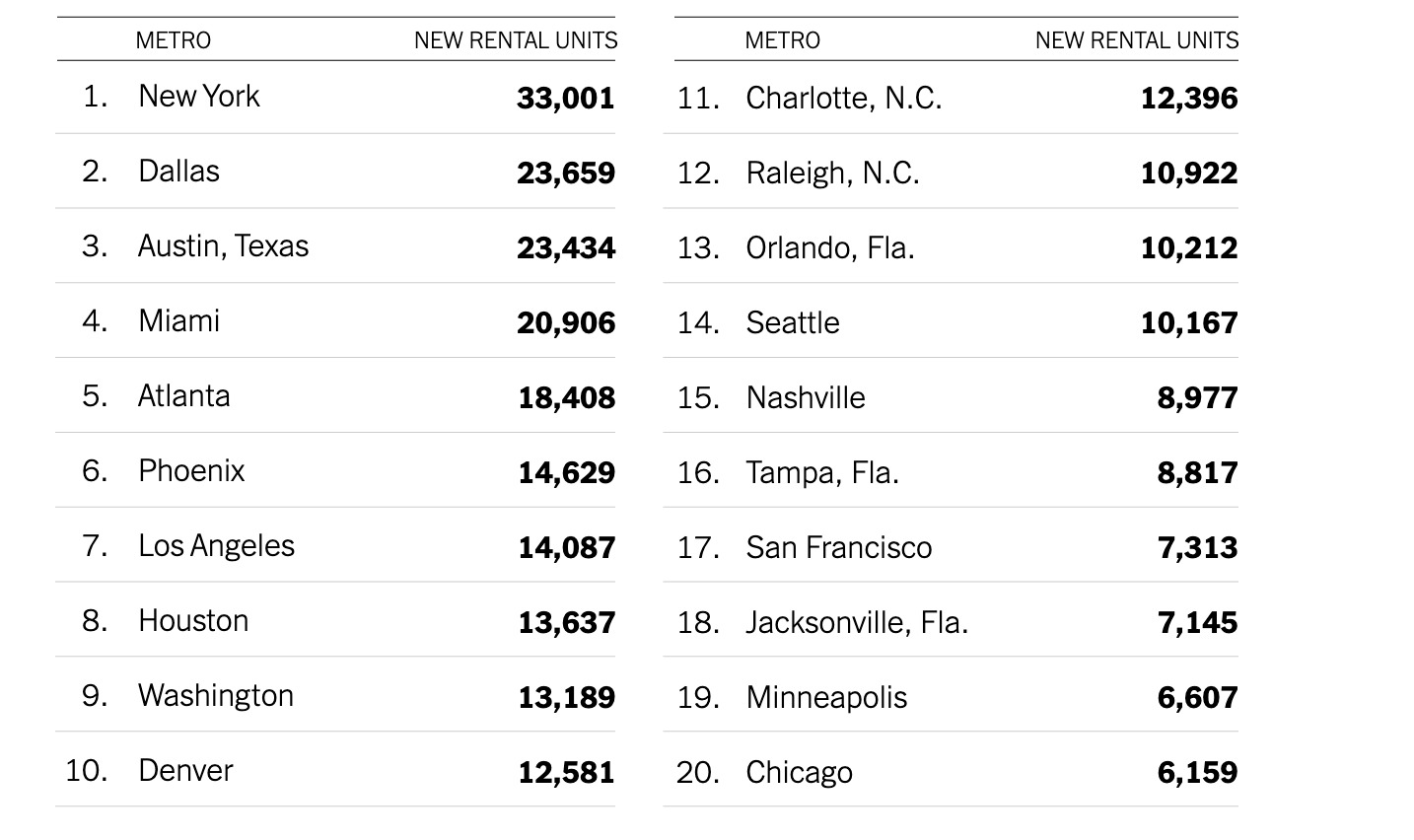

New York, Dallas, and Austin are the top three cities that studies predict will have the highest rates of new rental units completed in 2023. New York, out of the three cities, will have the highest number of new rental units built by 2023, totaling 33,001. The majority of the new rental units are high-end and offered for an expensive rental price. Survey shows that 41% of renters living in these areas are from an affluent economic class who can afford these high prices. Along with the increase of new rental units, there is a concern that affordable housing options will continue to decrease due to inflation and increased interest rates.

Michael Kolomatsky, There’s a Building Boom, but It’s Not for Everyone, The New York Times, https://www.nytimes.com/2023/09/28/realestate/theres-a-building-boom-but-its-not-for-everyone.html (Sept. 28, 2023).

The median home price in the U.S. is down 2% year-over-year due to rising interest rates, high inflation, and low housing inventory. However, the housing market is still relatively strong, and prices are expected to remain stable in the coming months.

Despite the slowdown, prices are still expected to increase by 2.9% in 2023. It is difficult to say when housing prices will drop, but factors such as rising interest rates, high inflation, and a decline in the stock market could lead to a decline in prices.

If you are thinking about buying a home, it is important to weigh all of the factors involved, including your financial situation, your needs and wants in a home, and the current state of the housing market.

Devon Thornsby and Kristi Waterworth, When Will Housing Prices Drop?, U.S. News, https://realestate.usnews.com/real-estate/articles/when-will-housing-prices-drop (Sept. 28, 2023).

The rising value of homes in Florida has now surpassed New York as the second most valuable housing market in the United States. This is due to a number of factors, including:

- An influx of people moving to Florida from other states: Florida has a no-income tax, a warm climate, and a variety of job opportunities, making it an attractive destination for people moving from high-tax states like New York and California.

- A limited supply of housing: Florida has a growing population but a limited supply of housing, which is driving up prices.

- Low interest rates: Low interest rates make it easier for people to afford to buy homes.

Furthermore, the rising value of homes in Florida is making it difficult for first-time homebuyers in Florida to afford a home, with the median home price in Florida now over $400,000.

Despite the rising value of Florida homes, The housing market in Florida is expected to remain strong in the near future. The state’s population is projected to continue to grow, and the supply of housing is expected to remain limited.

Ariel Zilber, Florida overtakes NY as nation’s second most valuable housing market, New York Post, https://nypost.com/2023/09/26/florida-overtakes-ny-as-second-most-valuable-housing-market/ (Sept. 26, 2023).

New York City has one of the first and most expensive carbon taxes and has especially felt the impact of carbon taxes in recent years. Landlords in New York City will face a $268 fine for every ton of carbon dioxide emitted beyond certain limits.

The impact of the emissions laws will initially be small but one will follow after the other with more costly problems faced by landlords, such as rising interest rates and vacancy rates.

Some big landlords with multiple properties around the country will face fines in multiple jurisdictions. For example, Boston Properties, one of the nation’s largest real estate investment developers, is likely to suffer carbon taxes on all of its properties located in Boston, New York, and Washington, D.C.

With more expansive carbon taxes expected, complying with local building standards will become increasingly important for all landlords and building owners. Some landlords are already making energy efficiency a priority.

Shane Shifflet, Buildings Are Empty, Now They Have to Go Green: Rising rates, falling occupancy and new carbon taxes hit building owners, The Wall Street Journal, https://www.wsj.com/real-estate/commercial/buildings-are-empty-now-they-have-to-go-green-7739f6c5 (Sept. 2, 2023).

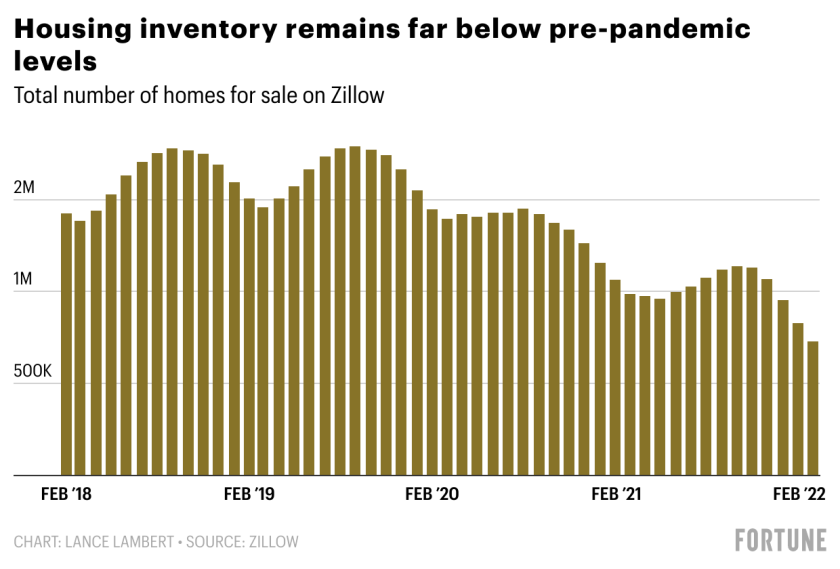

Although since May 2022, the active listings for homes have risen by 26%, the national housing market is yet to fully rebound since it hit record lows back in 2021 and early 2022. There are several factors that affect the low supply of homes, including less single family homes being built after the housing market crash in 2008, and an influx of first-time millennial homebuyers in 2022. As a side effect of the pandemic, many companies have begun to implement a remote work culture which gives people flexibility to move out from large, expensive cities to other parts of the country with low state and city property tax such as Nevada and Arizona. Consequently, investors are also attracted to those areas, bringing real estate developments and new constructions of apartments and multifamily dwellings. However, it is predicted that the demand in the housing market will also cool down because of rising interest rates. At this time, the desire to sell homes is low because the value of keeping a home is higher than selling and purchasing a new home to relocate. For buyers, the price of homes are projected to go down but they may be faced with limited inventory choices and expensive homeownership due to interest rate hikes.

Maryalene LaPonsie, Understanding Housing Inventory and What It Means for You, U.S. News & World Report, https://realestate.usnews.com/real-estate/articles/understanding-housing-inventory-and-what-it-means-for-you (Sept. 7, 2022).

New York City since early this year has been undergoing and adjusting to changes and fluctuations caused by the aftermath of the pandemic and inflation. Interestingly, both sale and rental prices now exceed 2019 levels. More domestic buyers, rather than international buyers, have been buying out luxury condos in Manhattan. With change in the real estate scene, the developers are finding that new adjustments must be made to cut costs and meet the new rental and sale demands post-COVID. Despite the increased need for work-from-home settings by renters, the average apartment sizes are getting smaller. Developers’ interests have shifted to the less expensive and crowded areas in boroughs outside of Manhattan, especially in Brooklyn and Queens with an expected number of 56,000 plus rental units to be ready for move-in between 2022 and 2025. Developers are acting quickly on a timeline to qualify for the renewed version of the 421a which expired in June 2022. The 421a is “a property tax exemption if your property value changed because you did construction on a multi-family residential building.” Benefits from the 421a property tax exemption depends on the location and use of the property, and whether or not it meets requirements for affordable housing.

Post-pandemic, the rental attraction factor is no longer on the size of the apartment but amenities such as outdoor space, wellness areas, and even a live-in physical trainer with his/her apartment in the same building. For condos, sales and prices have both rebounded from COVID times and has seen a significant increase from last year and before the pandemic. For developments that began construction during the pandemic, developers changed their plan, reduced the number of units and expanded space for residents overall to encourage attractiveness. However, sales and resales of condos are expected to fluctuate due to inflation. On the other hand, the market expects rental income to increase and/or stabilize with continued high demand.

Stefanos Chen, In New York City, the Demand for New Developments Is Bouncing Back, The New York Times, https://www.nytimes.com/2022/09/18/realestate/nyc-development-rentals-condos-covid.html (Sept. 18, 2022).